Real Data on Cloud Costs

Vantage uses anonymized data from thousands of connected accounts to snapshot industry spending patterns.

Q2 2025

While traditional cloud services like compute, storage, and databases remain the backbone of cloud provider revenue, areas like logging, security, and AI account for significant and growing portions of cloud spend.

Read more

Q1 2025

With year-over-year growth rates of 17%, 28%, and 35% respectively, cloud providers continue expanding beyond AI hype into core services like compute, storage, and observability. Notable trends include GCP's leadership in GPU instance adoption, a significant EC2 migration from compute-optimized c6 to balanced m6 instances, and an inverse relationship between organization size and observability spend percentage.

Read more

Q4 2024

While compute, storage, and databases remain the foundation of major cloud providers' revenue, there's a notable shift towards AI services. Still, the main priority for FinOps professionals is to optimize costs. While Amazon EC2 users are optimizing by committing and saving, there are other untapped areas for savings, such as switching to I/O Optimized database plans for Amazon and Azure VM commitments.

Read more

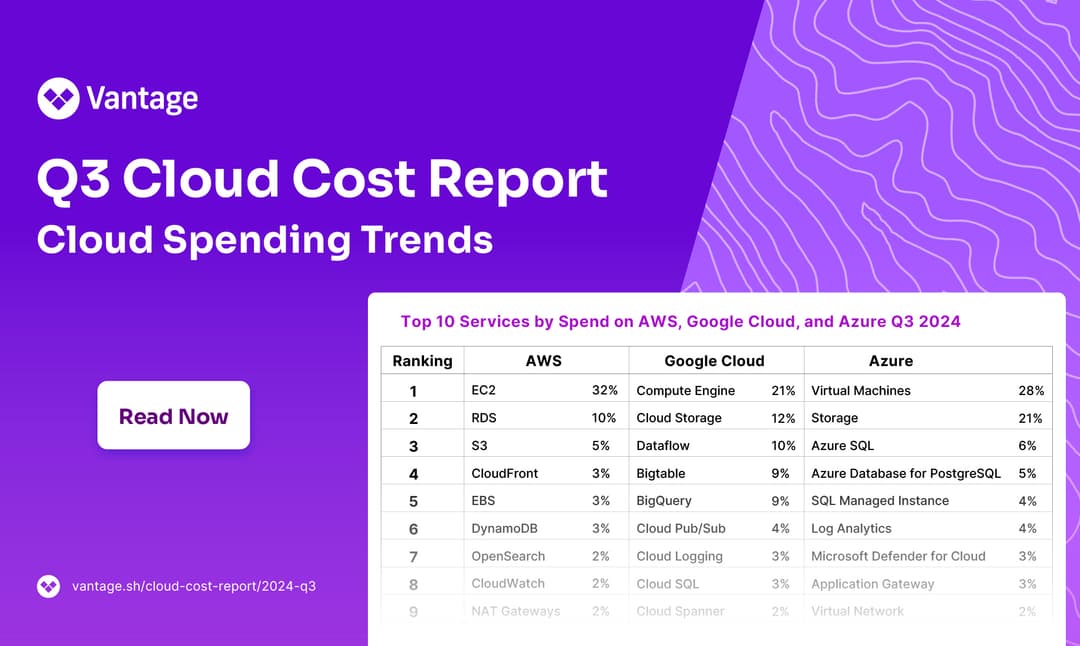

Q3 2024

Cloud growth continues, with GCP and Azure experiencing higher percentages of revenue increases compared to AWS. While AWS users are actively optimizing and saving, there is potential for users of other providers, like GCP and Datadog, to do the same by utilizing commitment plans and lower-cost storage classes.

Read more

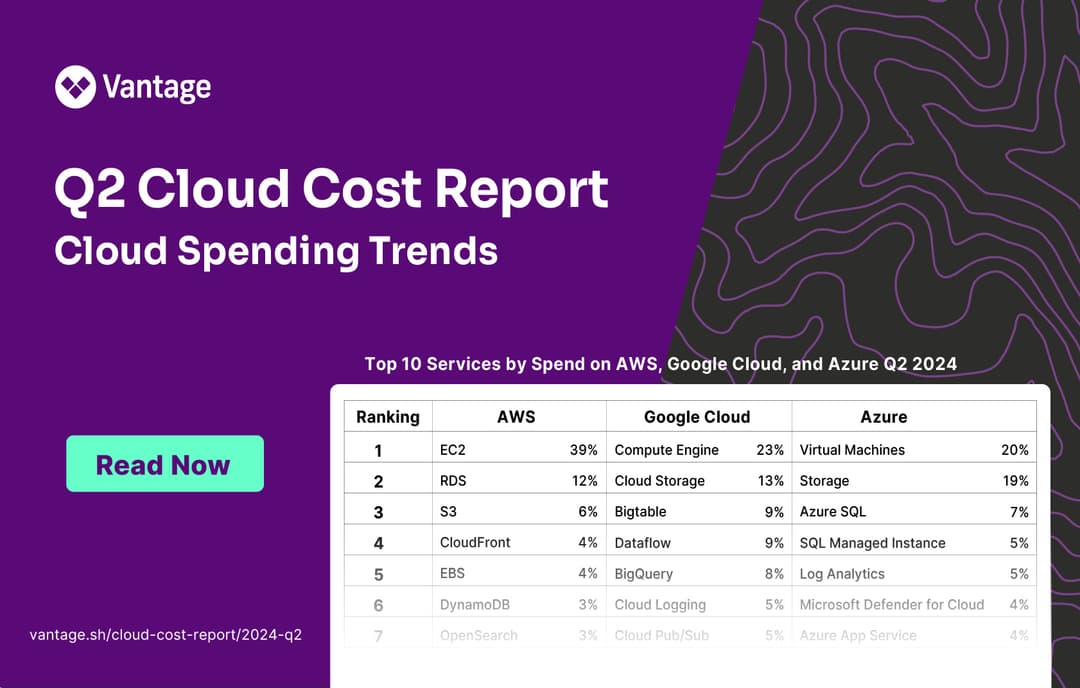

Q2 2024

The cloud market is experiencing strong growth, with increased adoption across all three major providers. In some areas, such as EC2, cloud users are making strides in optimizing their cloud usage. In other areas, there are still untapped, low-hanging opportunities for cost savings.

Read more

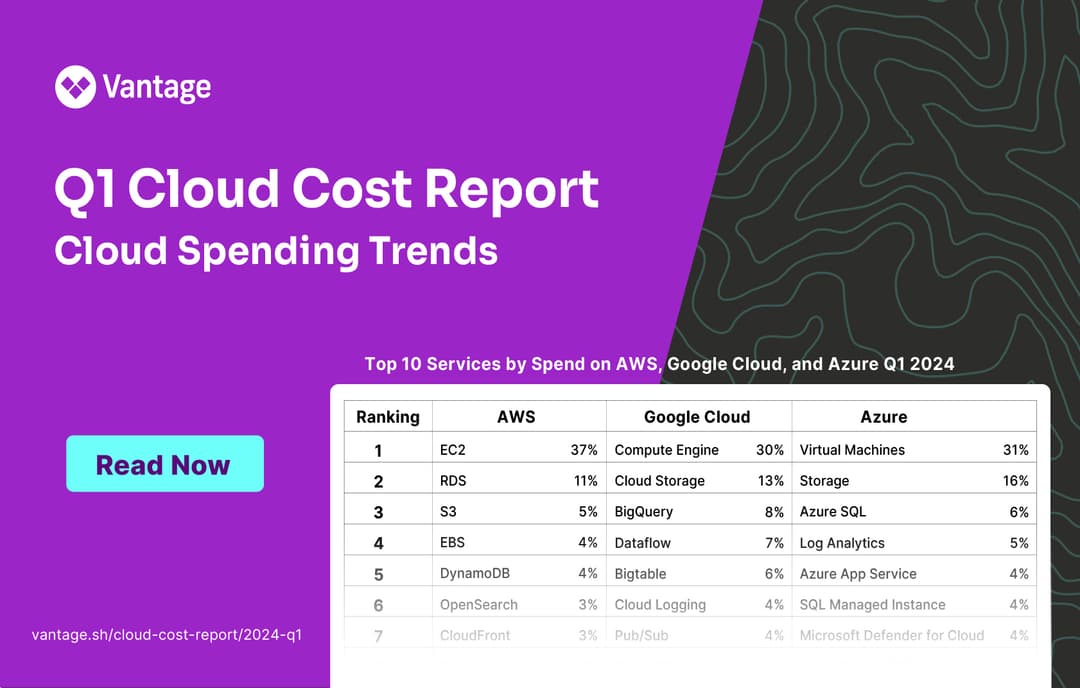

Q1 2024

Trends are showing cloud users continue to switch to newer and more cost-effective generations. Also, the growth of AI is impacting customer spending patterns.

Read more

Q4 2023

Big changes to discounting programs occurred in Q4. We provide advice on how to navigate the new landscape, plus perspective on cloud costs now that the 'era of cost optimization is over'.

Read more

Q3 2023

Is cloud provider revenue growth hitting a ceiling? Cloud users are looking to scale back costs more than ever. Q3 2023 found an uptick in spending optimization efforts. More companies are looking to save by switching away from On-Demand spending as well as upgrading to more cost-effective instances.

Read more

Q2 2023

Q2 2023 saw a crush of demand for GPUs and cheaper compute that resulted in capacity constraints across the major clouds. Increasingly, companies are using multiple clouds for different workloads.

Read more

Q1 2023

The first quarter of 2023 represented a return to normal among cloud spending, tracking with earnings reports from the hyperscaler clouds.

Read more

Q4 2022

In Q4 we found dramatic shifts in how companies were allocating costs, recording the lowest ever on-demand EC2 spend and a 16% drop in utilization of the most expensive S3 tiers. Data for serverless and database costs also demonstrates a new focus on cost optimization.

Read more

Q3 2022

In the inaugural Cloud Cost Report we profiled spending across compute, databases, storage, and serverless AWS costs to determine how companies were thinking about cloud infrastructure using real, anonymized data.

Read more